Free GST And Taxation Courses Online

Free online taxation courses are beneficial for those who want to learn Taxation from beginner to advanced level. These courses cover all aspects of taxation in India and internationally depending on the course that you have enrolled in. A free GST certification course is great for those who plan to build their career as a GST professional but they are still on the deciding stage. In simple words, those who want to first test whether GST is suitable for them or not and then they want to pursue it seriously. There are several free GST courses that can be chosen based on the requirement. Let us learn more about the benefits of enrolling in a free GST and Taxation certificate course online.

- Why Choose Free GST and Taxation Course

- List of Online Free Online GST and Taxation Certification Course

- 2.1 Audit, assessment and litigation

- 2.2 Maintai

Free online taxation courses are beneficial for those who want to learn Taxation from beginner to advanced level. These courses cover all aspects of taxation in India and internationally depending on the course that you have enrolled in. A free GST certification course is great for those who plan to build their career as a GST professional but they are still on the deciding stage. In simple words, those who want to first test whether GST is suitable for them or not and then they want to pursue it seriously. There are several free GST courses that can be chosen based on the requirement. Let us learn more about the benefits of enrolling in a free GST and Taxation certificate course online.

- Why Choose Free GST and Taxation Course

- List of Online Free Online GST and Taxation Certification Course

- 2.1 Audit, assessment and litigation

- 2.2 Maintaining documents, accounts and records

- 2.3 GST - when, where, who and how much?

- 2.4 Genesis and imposition!

- 2.5 Using input tax credit

- 2.6 Undertaking compliances

- 2.7 Claiming refunds and other concepts

Why Choose Free GST and Taxation Course

One should choose free GST and Taxation certification course for the following reasons:

- GST course online free is useful for those who want to first test whether a career as a GST professional is suitable for them. Free taxation courses are beneficial for those who want to understand which branch of taxation is good for them.

- Those who cannot afford a paid GST or taxation certification course can enrol in a free GST course. Through a free course online, learners will gain skills without the certification.

- Anyone who wants to enrol in multiple GST and Taxation courses can take up a free GST Taxation course online free.

List of Online Free Online GST and Taxation Certification Course

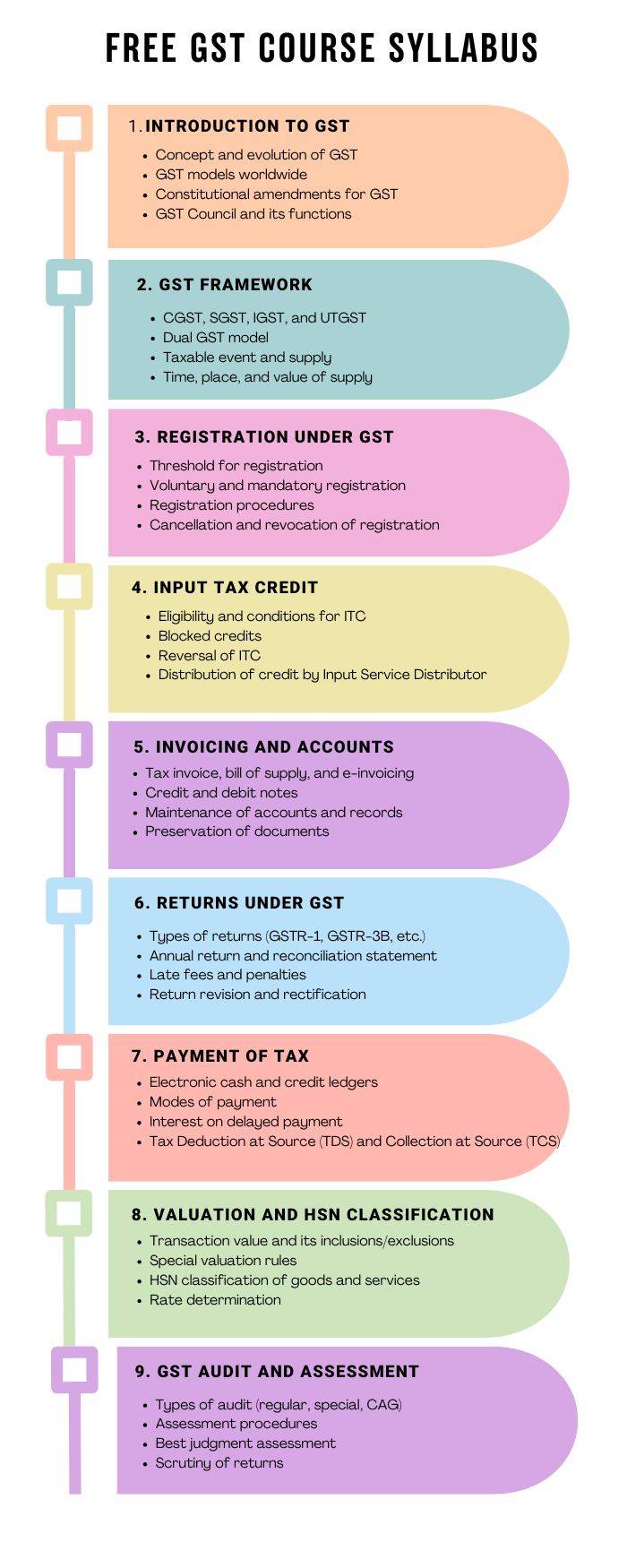

The following is a list of free GST and Taxation courses online that can be opted by those who want to gain GST and Taxation related skills:

Audit, assessment and litigation

This course covers frameworks of assessment under GST including Assessment by taxpayer and tax authorities. The course also covers GST audit, scrutiny of returns, SOP of scrutiny of GST returns etc. Topics like anti-profiteering will also be covered in this course where students will learn about the regulations in India that disallow any profit from GST.

Maintaining documents, accounts and records

This course teaches about e-invoices and E-waybills that must be generated at the transactional level. Learners will also get an understanding about accounts and records that must be maintained by businesses. Those who want to build a career in the field of GST-related compliance in India must enroll in this free GST course.

GST - when, where, who and how much?

In this course, students will learn how to identify the place of consumption of goods and services by the interpreting provisions related to place of supply. How to determine the place of goods supply will also be discussed in this course. The free GST course will be completed with a graded assessment on Place of Supply. Along with that, 2 hands-on projects including 'Determining inter-state and intra-state supplies' and 'place of supply' will also be covered.

Genesis and imposition!

This free GST course will discuss the pre-GST indirect tax framework and associated challenges faced which lead to the introduction of GST in India. The GST framework will be examined from both legislative and constitutional perspectives. The concept of 'supply' as defined by the GST law will be discussed in this course. Other important concepts such as inter-state and intra-state supplies, composite and mixed supply will be discussed in this course as well.

Check out this free GST course

Using input tax credit

This GST free course online discusses the utilization of the input tax credit. It will also discuss whether and when input tax credit that was availed should be reversed and what is the reason behind it. The course will help in analyzing whether tax paid on a purchase can be availed as the input tax credit.

Undertaking compliances

This GST free course helps in identifying the circumstances that create a need to amend or cancel the GST registration. Along with that, the process to obtain GST registration on the government portal including required documentation will also be discussed. The course will also discuss the need to fill various returns and the process to prepare GST returns which include the data and reporting requirements.

Claiming refunds and other concepts

First, the enrolled students will learn about the concept of zero-rate supply. They will also get an understanding of why different supplies are taxable but still have zero GST rate. GST refunds, their applicability, process to claim GST from tax authorities are also covered in this course. It is advisable that students take up the GST compliance course first, after which this course will be helpful in learning the technicalities.

Learn more about this online free GST course

Understanding the concepts of Taxation and GST are important for Taxation professionals since they need to have an in-depth understanding of tax from end-to-end. This is why enrolling in an online GST free course is beneficial for them. News and amendments in the GST are also included in these courses which make them relevant for practicing professionals.

All FiltersClear All

All FiltersClear All