PM Vidya Lakshmi Portal: Education Loan Application, Eligibility and More

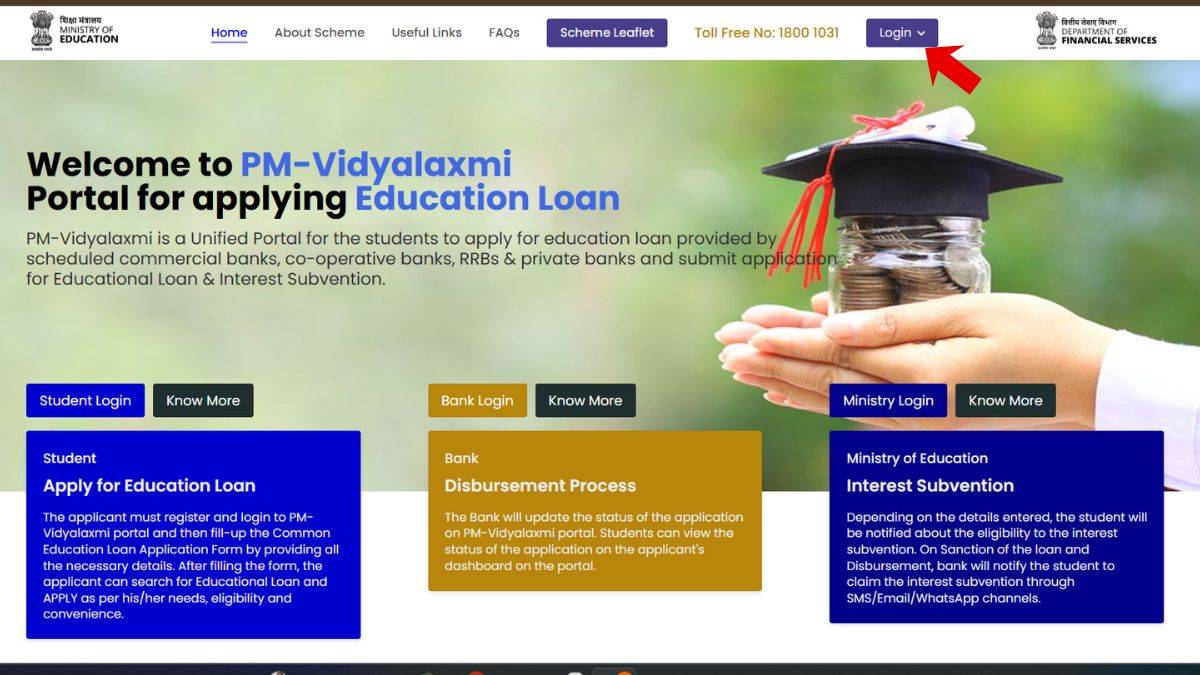

The Government of India launched PM Vidya Lakshmi Education Loan Portal to simplify education loan process. If you are a student who wants financial support to study in India this portal is helpful for you.

The PM Vidya Lakshmi Portal is a government backed platform. It helps students to easily search and compare education loan schemes for studies in India. Vidya Lakshmi Portal is developed by Ministry of Finance, Ministry of Education, and IBA. It provides centralized access to verified loan options from banks and financial institutions.

Through a single Common Education Loan Application Form, students can apply to up to three lenders simultaneously. This saves your time and documentation effort. The portal displays key details like interest rates, loan eligibility, repayment terms, and required documents. All this is important information that you want to know. In short, after this, students can evaluate the best education loan.

Vidya Lakshmi portal is now referred to as the PM Vidya Lakshmi portal. It is part of Pradhan Mantri Vidyalaxmi (PM-Vidyalaxmi) Scheme. This rebranding reflects the scheme's expanded role as a central government initiative to provide a common platform for students to apply for educational loans, access scholarship information, and track their applications in one place.

Note: It is also called as PM Vidyalaxmi Portal, PM Vidya Lakshmi Portal, PM-Vidyalaxmi portal, Pradhan Mantri Vidyalaxmi Portal and PM Vidyalakshmi education loan portal.

- What is PM Vidya Laxmi Portal?

- PM Vidya Lakshmi Portal Interest Rates 2026 (Updated)

- Benefits of PM Vidya Lakshmi Portal

- Eligibility for PM Vidya Lakshmi Scheme

- How to Apply for PM Vidya Lakshmi Education Loan?

- List of Banks Registered on Vidya Lakshmi Portal

What is PM Vidya Laxmi Portal?

Government of India launched PM Vidya Laxmi Portal with the objective that no student misses out on higher education for lack of funds. PM Vidya laxmi education loan portal is dedicated to students seeking student loans or scholarships, which is a first-of-its-kind portal. On this education loan portal, students can compare public Vs private education loan providers to select the best one for them.

Vidya Laxmi Portal is an online portal for students to explore, compare, and apply for educational loans and scholarships from anywhere and anytime. The portal also provides linkages to the National Scholarship Portal. Vidya Laxmi portal is helpful for Indian students who are looking for student loans in India.

PM Vidya Lakshmi Portal Interest Rates 2026 (Updated)

There is no single interest rate for PM Vidya Lakshmi scheme. ROI completely depends on bank. It can vary based on the bank and its education loan scheme. Repo rate is another factor to decide ROI. If the Reserve Bank of India increases repo rate, banks will increase the interest rate. We have mentioned the bank-wise rate of interest for the education loan:

| Banks |

Education Loan Interest Rates in India |

Processing Fees |

|---|---|---|

| 9.15% to 11.15% depending on loan amount and security |

INR 10,000 |

|

| 10.25% to 14.00% (iSMART Scheme), average 11.27% per annum |

Upto 2% + GST |

|

| 12.50% to 13.70% approx. Depending on the borrower profile |

2%+ GST |

|

| Canara Bank |

8.25% to 11.10% depending on the loan scheme |

0.5% of Total Amount |

| 7.90% to 12.90% |

Zero processing fees on collateral-free education loans |

Yes this is true that every student wants to get an education loan at a low interest rate. It can significantly reduce your repayment burden. So, explore options before selecting or applying for any student loan.

Related Blog:

This portal is backed by the Government of India under the government’s guarantee cover scheme for Indian banks. If any student who borrowed 7.5 lakhs to study in India is not able to repay the amount, then the government will pay the amount.

Comparing different student loan options and then calculating the total repayment amount using the education loan EMI calculator is a time-consuming process. Here, Vidya Lakshmi Portal comes as a saviour for students. It is a single-window portal with a user-friendly interface to solve issues related to finance for higher studies. Let’s discuss the advantages of this portal for students in detail.

Predict your IELTS, TOEFL, and PTE in just 4 steps!

Benefits of PM Vidya Lakshmi Portal

PM Vidya Lakshmi Portal aims to make the loan process easy for students. Keeping this in mind, this portal has various student-friendly features and benefits to avail student loans easily.

-

Simplified Application: Use a single, common application to apply to up to 3 different banks simultaneously.

-

Easy Comparison: View and compare multiple education loan schemes in one place.

-

Zero Visits Required: Apply for and manage your loan application without physically visiting bank branches.

-

Single-Window Document Upload: Upload all necessary documents in one place.

-

Real-Time Tracking: Track your application status instantly, as banks update it in real-time.

-

No Portal Charges: The use of the Vidya Lakshmi portal is free for applicants.

-

Universal Coverage: A single portal for students pursuing education both in India.

Now, you know the benefits of using this single window portal for student loans. Let us discuss who is eligible to apply for an education loan by using this portal.

Eligibility for PM Vidya Lakshmi Scheme

The eligibility criteria for education loans are different from admission eligibility. Banks check the profile of students before approving the loan application. The eligibility criteria to apply for education loans by using the Vidya Lakshmi portal are mentioned below:

- Citizenship: Students must be citizens of India.

- Education Qualification: Should have passed the 10+2 board exam.

- Entrance Exams: Students must pass the required merit entrance exam for admission into college.

- Admission Letter: Get admission into top 860 quality Higher Educational Institutions (QHEIs)

These are just the basic criteria for the Vidya Lakshmi scheme. You may need to complete some other requirements or submit documents to borrow an education loan if any bank asks for it.

How to Apply for PM Vidya Lakshmi Education Loan?

To begin the application process, students need to create a new user profile on the Vidyalakshmi portal. Here is the steps to create a new profile on the portal.

Step 1 of PM Vidya Lakshmi Scheme Application Process

- Visit the official website of PM Vidya Lakshmi Portal, "https://pmvidyalakshmi.co.in/"

- Click on "Log In" and then "As Student."

- Create a new account by using personal details like name, email, phone number, etc.)

Step 2 of Vidyalakshmi Scheme Application Process

After completing the first step of registering as a new user, the next step is to apply for a Vidhya Lakshmi education loan. Use, login credentials to access your account on the portal. Here is the step-by-step process to help you in the Vidya Lakshmi application process.

- Select the “Search and Apply for Loan” option.

- Now, select the country where you want to study (India)

- Select the course you want to pursue.

- Select the amount you need to finance your higher studies.

- Select suitable terms and conditions for repayment, and select three preferred banks to apply for the Vidya Lakshmi education loan.

- Upload the required documents as asked.

- Do a quick check on the details that you are going to submit.

- After following all the steps mentioned above, click on the “Submit” option.

Now, you can check your loan status on the portal as banks update the status. Also, you can ask banks if you have any queries related to your education loan.

| Security Alert: Vidya Lakshmi never asks for any payment. Do not make payments or scan QR codes for loan approval. |

|---|

Documents Required for Vidya Lakshmi Education Loan

Here is the list of documents for education loan. Students need these to keep handy at the time of submitting the application form.

- Two passport-size photos of students and Co-applicants

- Government-approved Photo ID cards such as PAN card, Aadhar card, etc.

- Birth certificates of applicant.

- Academic documents for 10th and 12th classes, passing certificate or equivalent.

- A letter of admission from the university, along with the fee structure of the course.

If applicants are salaried employees, then they need to submit the salary slip, IT return, and Form-16.

List of Banks Registered on Vidya Lakshmi Portal

According to the official website of PM Vidya Lakshmi portal, there are 38 banks registered. Here is the list of banks registered on the portal of Vidya Lakshmi. Students can apply to get education loan offered by these banks.

- Abhyudaya Cooperative Bank Limited

- Andhra Pragathi Grameena Bank

- AXIS BANK

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Chhattisgarh Rajya Gramin Bank

- CITY UNION BANK LIMITED

- Dombivli Nagari Sahakari Bank Limited

- Federal Bank

- GP PARSIK BANK LTD

- HDFC Bank

- ICICI Bank

- IDBI Bank

- IDFC First Bank

- Indian Bank

- Indian Overseas Bank

- Jammu and Kashmir Bank Limited

- Karnataka Bank Limited

- Karnataka Gramin Bank

- Karnataka Vikas Grameena Bank

- Karur Vysya Bank

- Kerala Gramin Bank

- Kotak Mahindra Bank

- New Indian Cooperative Bank Limited

- Punjab and Sindh Bank

- Punjab National Bank

- Rajasthan Marudhara Gramin Bank

- RBL Bank Limited

- State Bank of India

- Tamilnad Mercantile Bank Limited

- The Kalupur Commercial Co Op Bank LTD

- The South Indian Bank LTD

- UCO Bank

- Union Bank of India

- Yes Bank

That's all about the PM Vidya Lakshmi Portal. We hope that this information will be helpful for you to finance your higher education expenses. You can select the ideal education loan according to your needs and apply for it using the Vidyalakshmi education loan portal.

For help with university applications, students seeking to study abroad can contact our Shiksha Study Abroad Counsellors. The comments section below allows candidates to contact us as well.

There is no fixed rate of interest rate for Vidya Lakshmi education loan portal. The interest rate depends on the requirements of candidates and schemes of the bank. It usually starts at 8.40% and can go up to 18% depending on the student's need. The REPO rate plays an important role in this.

If you are unable to log in to the Vidya Lakshmi portal, make sure that you are using the login and password correctly. If you forget, then reset it.

Second option is to make sure internet connection is stable or working. If problem persists, try reconnecting.

If both don't work, connect on toll free number of the portal. You will get customer support for technical assistance.

Pick your stage and get free guidance from counsellors who've helped thousands get into top universities.

Starting research

Starting research Shortlisting colleges

Shortlisting colleges Exam preparation

Exam preparation SOP/LOR writing

SOP/LOR writing Scholarship & finance

Scholarship & finance Visa application

Visa application

Comments

(2)

T

9 months ago

Students need to ensure that they are eligible to apply for education loans through the Vidya Laxmi portal. Then applicants need to create a new account and fill up the Common Education Loan Application Form (CELAF) with the required information. There candidates can select the education loan scheme according to their need.