SBI Education Loan for Abroad Studies : Eligibility & Interest Rate

State Bank of India offers education loan to study in India or abroad. Eligible students can apply for study loan offered by SBI. Always check rate of interest, repayment amount, and other details before applying for SBI education loan to study abroad.

How much Education Loan can I get from SBI for abroad studies? When it comes to studying out of India the major concern for students is financing. Borrowing an education loan for abroad studies from banks and NBFCs is the smartest way to arrange funds. Students can borrow any amount between INR 7.5 lakhs and INR 1.5 crore under the SBI education loan for abroad studies.

Keep in mind that SBI offer study loans for studying in India and abroad. This article is for students who want to study out side India. State Bank of India is one of the top education loan providers in India.

SBI education loan interest rate is 11.15%. There is a 0.50% concession in interest for girl students. The SBI education loan is famous for slightly lower interest rates and easy repayment methods. In this blog, we are going to discuss all the information about the State Bank of India education loans for studying abroad or in India.

- SBI Education Loan for Abroad Studies in 2026

- SBI Global Ed-Vantage Scheme Eligibility

- What is SBI Shaurya Education Loan Scheme?

- Documents Required for SBI Education Loan

- Expenses Covered by SBI Global Ed-Vantage Scheme

- Collateral for SBI Student Loan

- SBI Education Loan Interest Rate 2026

- How Much Will My SBI Education Loan EMI Be?

- Case Study: Understanding Your SBI Education Loan for Abroad Studies

SBI Education Loan for Abroad Studies in 2026

Students looking to study abroad can apply for SBI Global Ed-Vantage. It is a part of the SBI Education Loan for abroad studies scheme. Under this loan scheme, eligible students can borrow up to INR 1.5 Crore as the SBI student loan for pursuing higher education abroad.

SBI Global Ed-Vantage

An education loan initiative introduced by the SBI Education Loan, SBI Global Ed-Vantage, is exclusively provided to students opting for full-time regular courses at foreign colleges and universities. Depending upon the course and the Institute of choice, the loan amount varies from INR 7.5 lakhs to 1.5 Cr. For education loan without collateral, you need to fullfill eligibility. Check out overveiw of SBI education loan for abroad studies.

Key Highlights for SBI Global Ed-Vantage Scheme

| Key Highlights for SBI Global Ed-Vantage Scheme | |

|---|---|

| Purpose | Higher education abroad (UG, PG, Diploma, Doctorate) |

| Eligible Courses | Full-time, regular programs only |

| Eligible Countries | USA, UK, Canada, Australia, NZ and 23 other countries |

| Loan Amount | INR 7.5 Lakh to INR 3.00 Crore (Higher amounts up to INR 3 Cr considered on case-to-case basis) |

| Collateral-Free Option | Up to INR 50 Lakh (For Selected Premier Institutions Only) |

| Collateral Requirement | Required for Loans Above INR 20 Lakh (Exempted for Select Institutes) |

| Interest Rate (as of December 2025) | Starts at 8.90% (With collateral). 0.50% concession in interest for girl students |

| Processing Fee | INR 10,000 + GST |

| Moratorium Period | Course duration + 6 months |

| Repayment Tenure | Up to 15 years (post-moratorium) |

| Disbursement Mode | Direct to institution |

| Co-applicant Requirement | Mandatory (parent/guardian/spouse/sibling) |

| Pre-visa Disbursement | Available |

SBI Global Ed-Vantage Scheme Eligibility

Before applying for the SBI Global Ed Vantage Education Loan, students must first check eligibility. Below is a list of conditions that candidates need to satisfy before applying for SBI Education Loan:

- Nationality: Applicant must be an Indian citizen.

- Age: They must be at least 18 years old.

- Accepted Countries: Admission letter from a university in USA, UK, Canada, Australia, Singapore, Japan, Hong Kong, New Zealand, or Europe.

For more details on eligibility, visit Eligibility Criteria for Education Loan.

Predict your IELTS, TOEFL, and PTE in just 4 steps!

What is SBI Shaurya Education Loan Scheme?

The SBI Shaurya Education Loan Scheme is a special financial plan. It is designed for the families of our nation's protectors. This scheme supports the children and spouses of Defense personnel, Indian Coast Guard, and Central Armed Police Forces (CAPF). It helps them pursue higher education without money problems. You can use this scheme for studies in India or as an SBI Education Loan For Abroad Studies.

The bank offers quick approval for these applicants. You can apply for this loan from your permanent home or your place of posting. It is a hassle-free process with special benefits.

SBI Shaurya Education Loan: Limits and Charges

The table below details the loan quantum, margin requirements, and processing fees applicable under this scheme.

| Loan Parameter | Scheme Details |

|---|---|

| Loan Amount (India) | Maximum INR 40 Lakhs |

| Loan Amount (Abroad) | Maximum INR 1.50 Crores |

| Repayment Tenure | Up to 15 Years (after moratorium) |

| Margin (Up to INR 4 Lakhs) | NIL (No margin required) |

| Margin (Above INR 4 Lakhs) | 5% |

| Processing Fee (Up to INR 20 Lakhs) | NIL |

| Processing Fee (Above INR 20 Lakhs) | INR 10,000 + Taxes |

Note on EMI Generation: The interest accrued during the course and moratorium period is added to the principal amount to calculate the EMI. However, if you service (pay) the full interest during the course period itself, your EMI will be calculated based on the principal amount only, reducing your future burden. Check out some tips to repay education loan faster.

Documents Required for SBI Education Loan

Applying for an SBI education loan to study abroad is straightforward. If you have your paperwork ready. SBI offers specialized schemes like Global Ed-Vantage for overseas studies. It provides loans up to INR 3 Crores. Having these documents organized ensures faster processing and early sanction before your visa interview.

Check out list of documents required for SBI education loan for abroad studies application.

| Section | Document Type | Details / Examples |

|---|---|---|

| Student Applicant | Proof of Identity | Passport (mandatory), Driver’s License, PAN, Voter ID |

| Proof of Address | Electricity/Water/Telephone/Piped Gas Bill, Passport, Driving License, Aadhaar Card | |

| Mandatory | Valid Passport | |

| Academic Records | ||

| Admission Proof | Offer/Admit Letter (conditional also acceptable) | |

| Course Expense Statement | Schedule of Expenses / Cost of Study | |

| Photographs | 2 Passport-size photos | |

| Existing Loan (if any) | Loan A/C statement for last 1 year | |

| Co-applicant | Proof of Identity | Passport, Driver’s License, Voter ID, PAN |

| Proof of Address | Electricity/Water/Telephone/Piped Gas Bill, Passport, Driving License, Aadhaar Card | |

| Photograph | 1 Passport-size photo | |

| Existing Loan (if any) | Loan A/C statement for last 1 year | |

| III. Income Proof (Salaried Co-applicant/ Guarantor) | Salary Proof | Latest 3 months’ Salary Slips or Certificate |

| IT Proof | IT Returns or Form 16 (last 2 years) acknowledged by IT Dept. | |

| Bank Statement | Salary Account – last 6 months | |

| IV. Income Proof (Self-employed Co-applicant/ Guarantor) | Business Proof | Business address proof (if applicable) |

| IT Proof | IT Returns (last 2 years) | |

| TDS Certificate | Form 16A (if applicable) | |

| Professional Certificate | Doctor/CA/Other Professional Qualification Certificate | |

| Bank Statement | Last 6 months |

Note: All documents should be self-attested.

Expenses Covered by SBI Global Ed-Vantage Scheme

Wondering what the expenses are covered under your sanctioned SBI Education Loan amount? Worry no further, read on to know about the expenses that would be taken care off with the loan amount.

- The tuition fee payable towards college/school/hostel facilities.

- All expenses paid towards Examination/Library/Laboratory amenities.

- Travel expenses/passage money required for studies abroad.

- The purchase of books/equipment/instruments/uniforms/ computer at a reasonable cost, if required for course completion and any other expense required to complete the course– like study tours, project work, thesis, etc. would be considered for a loan, subject to the condition that these should be capped at 20% of the total tuition fees payable for completion of the course.

- Caution deposit /refundable deposit/ building fund supported by Institution bills/receipts would be considered for a loan on condition the amount does not exceed 10% of the tuition fees for the entire course.

Collateral for SBI Student Loan

The State Bank of India, under its SBI Global Ed-Vantage Scheme, will accept the following guarantee (security) against the loan amount:

- Tangible collateral security

- Collateral security offered by a Third Party (other than parents) would also be considered

To know more about collateral, read Collateral for Education Loan.

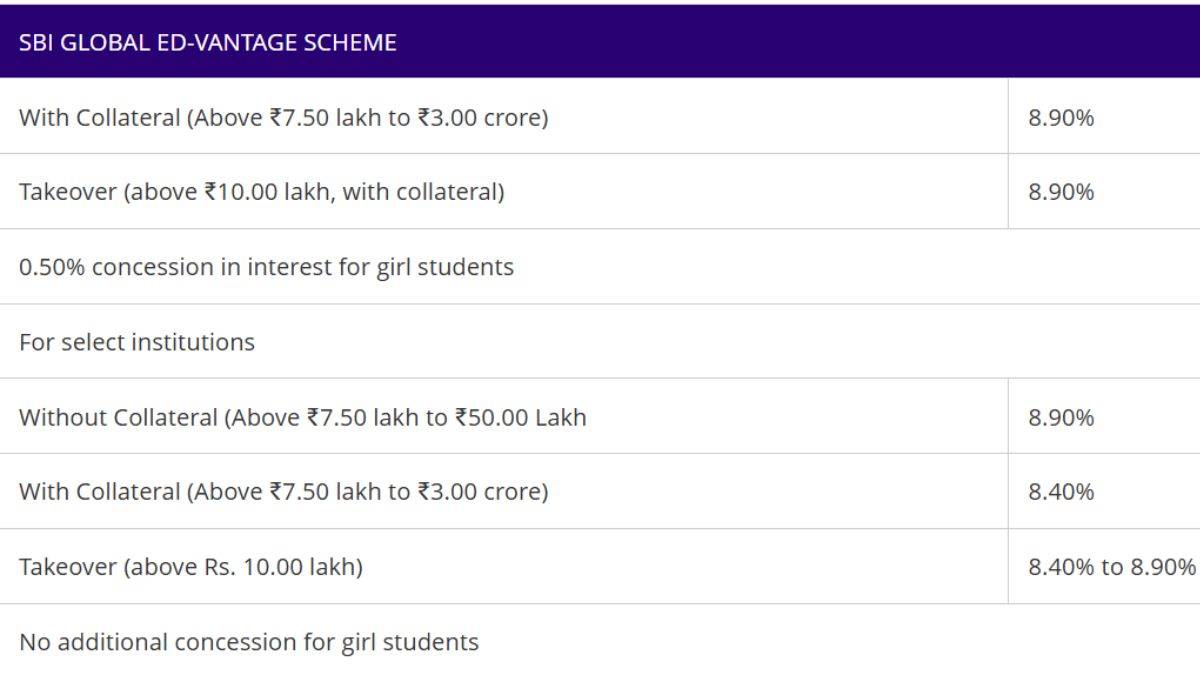

SBI Education Loan Interest Rate 2026

The interest rate of State Bank of India student loan totally depends on the repo rate decided by the Reserve Bank of India. The SBI Education Loan interest rate is what the student would be required to pay:

Moratorium Period

The SBI Education Loan repayment period, or the moratorium period, would commence 6 months after the completion of the said course. Accrued interest during the moratorium period would be added to the principal amount, and repayment can be made in easy EMI options. Repayment can be spread across but not exceeding 15 years.

How Much Will My SBI Education Loan EMI Be?

Calculating your monthly EMI is a vital step in planning your study abroad journey. It helps you understand your future financial commitments before you even leave for your course. Your EMI depends on the loan amount, the floating interest rate, and the tenure you choose. Here are a few examples of scenarios to help you plan:

| Loan Amount | Interest Rate | Repayment Period | Approximate EMI |

|---|---|---|---|

| INR 10,00,000 | 11% | 7 years | INR 17,100 |

| INR 30,00,000 | 11% | 10 years | INR 41,330 |

| INR 50,00,000 | 11% | 15 years | INR 56,800 |

Case Study: Understanding Your SBI Education Loan for Abroad Studies

To help you understand how the SBI Global Ed-Vantage loan terms work in a real-world scenario, let's look at a practical example. We have calculated the EMI based on a highly competitive rate achievable with a strong credit profile.

The Profile:

- Student: Rahul Sharma (Male)

- Target University: California State University, USA

- Course: 2-year Master's program in Computer Science

- Loan Requirement: INR 50 Lakh

- Co-borrower Credit Score: 787 (Excellent - qualifies for risk premium concession)

| Loan Detail | Value/Term | Calculation & Impact |

|---|---|---|

| Loan Amount | INR 50,00,000 | Falls within the eligible limit (Min INR 7.5L – Max INR 1.5 Cr). |

| Interest Rate (Effective) | 9.10% | Base Rate adjusted for High CIBIL Score (787) + 'Rinn Raksha' Insurance Concession. |

| Moratorium Period | Course Duration + 6 months | 2 years (Course) + 6 months = 30 months where no EMI is mandatory (Simple interest accumulates). |

| Repayment Tenure | 15 years | Maximum tenure allowed after the moratorium period ends. |

| EMI Calculation | ~ INR 50,942 / month | Calculated on INR 50 Lakh principal @ 9.10% interest for 15 years. |

Key Takeaways for Rahul:

- EMI Savings: By maintaining a high CIBIL score (787), Rahul reduced his effective interest rate to 9.10%, lowering his monthly obligation to approximately INR 50,942.

- Collateral Requirement: Even with a high credit score, the Global Ed-Vantage scheme requires Tangible Collateral (property/FD) for a 50 Lakh loan.

- Moratorium Interest: While he doesn't pay during the 2.5-year moratorium, simple interest of approx. INR 11.3 Lakhs will accumulate and be added to the principal before EMI starts.

SBI Education Loan interest rate is 11.15% for students who want to study abroad or in India. There is 0.50% concession in interest rate for girl students. This ROI type is floating and it can be changed with repo rate.

Education loans for MBA abroad typically cover tuition and admission fees. This includes cost of books, study materials, travel expenses like airfare, and living costs such as boarding and lodging. Bank may cover health insurance premiums. It depends on lenders.

Pick your stage and get free guidance from counsellors who've helped thousands get into top universities.

Starting research

Starting research Shortlisting colleges

Shortlisting colleges Exam preparation

Exam preparation SOP/LOR writing

SOP/LOR writing Scholarship & finance

Scholarship & finance Visa application

Visa application

Comments

(20)

2 years ago

R

2 years ago

R

3 years ago

Hello Athulya. This would entirely depend on the bank you are applying for the loan from. Hence, I would request you to approach multiple banks and decide on the one that suits your interests. you can also try out our education loan tool here: https://studyabroad.shiksha.com/apply-education-loan

m

4 years ago

R

3 years ago

K

4 years ago

R

4 years ago

Hello Kamalprret. Most banks provide education loans. You should just get in touch with a bank close to you to understand the loan application process. You can also make use of our Education loan tool: https://studyabroad.shiksha.com/apply-education-loan

B

4 years ago

R

4 years ago

Hello Bhumika. You are required to apply for an Education Loan if you want to use the money for studying. You can get in touch with a bank near you to understand the loan process. You can also use of our education loan tool, here: https://studyabroad.shiksha.com/apply-education-loan

Here are some key features of SBI global ed vantage loan scheme