Education Loan Repayment: Tips to Pay Student Loan Faster

if you're going to borrow a student loan to study abroad, you should learn the tips to make study loan repayment faster. Without guidance and no planning for loan repayment will push you towards debt and you'll find your education loan more expensive.

How to pay Education loan faster? What are the hacks to be student loan debt-free early? Education loans are a boon for students facing financial issues to fund their studies. Today, taking a student loan for studying abroad or in India is easy. Students face a major challenge at the time of education loan repayment. When a student starts working abroad, they juggle managing living expenses while also paying off their student loan.

Banks start charging interest on the loan amount after one year of completing your course. Note that, for a loan with a longer tenure you need to pay an extra interest amount. However, you can save thousands, even lakhs, of rupees by paying a loan faster. In this blog, we are going to tell you the Education Loan Repayment tips.

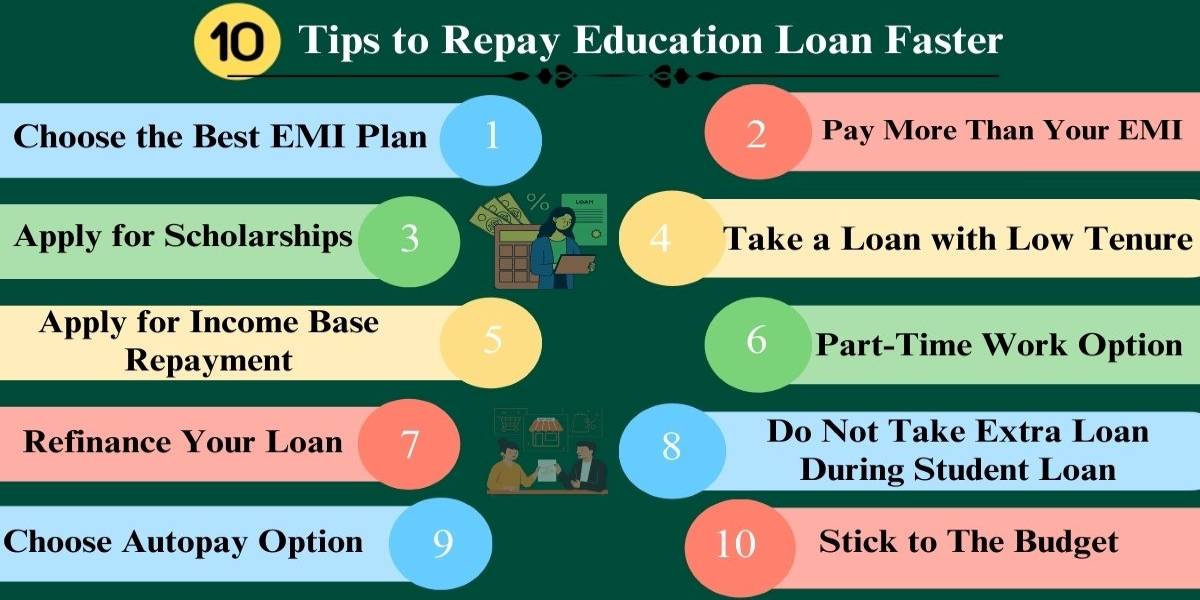

- 10 Tips to Pay Education Loan Faster

- 1. Choose the Best EMI Plan

- 2. Pay More Than Your EMI

- 3. Education Loan With Low Tenure

- 4. Refinance Your Loan

- 5. Earn While You Learn

- 7. Choose the Auto Pay Option

- 8. Stick to Your Budget

- 9. Apply for Income-Based Education Loan Repayment

- 10. No Extra Loan During Student Loan Repayment

- Government Schemes

- Ask Your Employer to Help

10 Tips to Pay Education Loan Faster

A good education is the only way to fulfil your dreams. Students borrow loans from Banks and NBFCs to fund their studies, but without planning your desired degree can turn out to be expensive. Later, students just want to get rid of this anyhow.

Here are some tips that can help you to make education loan repayment quickly. Due to this, you can be debt-free in your early career days. Check out the tips.

- Choose the Best EMI Plan

- Pay More Than Your EMI

- Take a Loan with Low Tenure

- Refinance Your Loan (If you have a good credit score)

- Generate Money While Studying (Part-Time Work Option)

- Apply for Scholarships

- Choose Autopay Option

- Stick to the budget

- Apply for Income-Based Repayment

- Do Not Take Extra Loan During Student Loan

1. Choose the Best EMI Plan

Here, choosing the best EMI Plan means, you select the plan that suits your pocket. Paying more than your budget can push you towards financial problems. Also, it is possible that you may miss an EMI and the bank will put penalty charges for this. That’s why it is suggested to select the EMI according to you for education loan repayment. Use the education loan calculator to compare your loan

For example: If your ROI (Salary) is 1 Lakh per month then try to pay at least 30% of your salary.

Predict your IELTS, TOEFL, and PTE in just 4 steps!

2. Pay More Than Your EMI

How Can I pay student loan faster? The easy answer is to pay more than your EMI. When you more than your EMI then the extra amount you pay reduces your principal amount. The low total amount is equal to a lower interest amount.

If you get a high-paying job or you get extra money, pay again your education loan. These small amounts can reduce your total principal amount significantly.

For Example- You got promoted and now your salary is INR 2 lakhs per month. Your EMI is INR 30,000. Apart from paying EMI, you can pay 10 or 20 thousand extra to reduce the total amount.

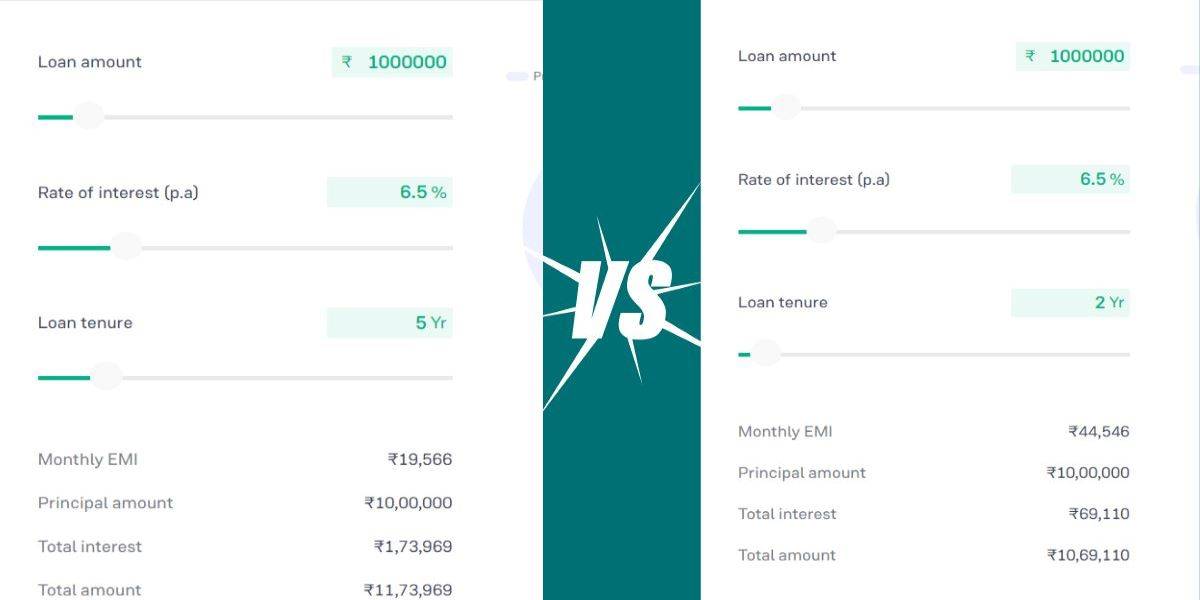

3. Education Loan With Low Tenure

The best strategy for making education loan repayments early is to borrow a loan with a low term. The con of such loans is the need for larger monthly payments. While the benefit is you will save a lot of money in interest paid towards your loan. You can see the difference in the image below:

4. Refinance Your Loan

After completing your graduation and getting a job, you can consider refinancing your loan. Explore loan options by other money lenders and choose the refinancing of your education loan with a low-interest rate. With a better credit score and a job, the chance of getting a loan at a low interest rate is high.

Related Read:

5. Earn While You Learn

If you took an education loan, it means money is a little tight. But don’t worry! This cost you can cover while working part time jobs abroad. If you have the required skills you can get on-campus or off campus jobs like helping out at a store, working in the library, or even doing online work.

The money you make can help you to cover the expenses of your food, books, and travel. In case you saved some money, then start paying back your loan while you’re still studying. By this way, you’ll end up paying less interest later. Even a small amount helps!

6. Apply For a Scholarship

Top universities in the world and some countries offer scholarships to international students. In simple words, it is free money which you don’t have to pay back. Check out the scholarships you are eligible for and apply as early as possible because some scholarships go to the first people who ask. Getting a scholarship means you need to borrow less money, or it might even cover all your fees.

Related Read: How to Apply for Scholarships?

7. Choose the Auto Pay Option

Auto Pay is like setting an alarm for your money. The bank takes out your loan payment automatically every month. You don’t have to remember the date or worry about missing a payment. Just keep enough money in your account so the payment goes smoothly, no stress, no extra charges.

8. Stick to Your Budget

This tip is one of the best ways to Save Money as a Student While Studying Abroad. Make a monthly budget and follow it strictly. It will stop you from overspending on anything. Ultimately, you will save money and you can either repay your study loan or you can use it in a different way.

There is a rule called 50/30/20 rule. According to this rule, use 50% of your income for necessities, 30% of your income for your wants and 20% of your income for savings.

9. Apply for Income-Based Education Loan Repayment

Income-based education loan repayment is a rare feature in India. The Income-based study loan repayment feature adjusts your monthly payment (EMI) based on your salary. For example, if your salary drops from ₹1 lakh to ₹50,000, the EMI would be adjusted to reflect your lower income. As mentioned, not all the banks offer this feature, so you need to do a research for this.

10. No Extra Loan During Student Loan Repayment

Take no extra loan until you pay the last EMI of your study loan repayment. This is a common mistake many students make. They start working, receive their salary, and begin spending on wants like cars, gadgets, or even homes. This is a financial blunder that can lead to significant hardship down the road.

Government Schemes

Other than the above-mentioned tips, you can choose to take the help of government education loan schemes. The central government is running the Central Sector Interest Subsidy (CSIS) scheme. This is a government scheme you should know if you are going to apply for a student loan.

Central Sector Interest Subsidy (CSIS) Scheme

The CSIS scheme is an initiative taken by the Government of India to ease the financial burden of education loan repayment from students in India. Under this scheme, eligible students will get an interest subsidy on the education loan up to 10 lakhs. However, this is only for studying in India and not for studying abroad.

Related Articles

Ask Your Employer to Help

Several employers in the world offer loans to their workers. You can ask your employer to help for education loan repayment. The benefit of borrowing this loan is that you can get it at a lower interest rate. Also, the EMI for this loan will automatically be deducted from your monthly salary. That’s how you can pay your student loan faster.

This is all about how you can repay your education loan quickly and become debt-free. If you have any queries, feel free to ask, and we will be happy to answer. You can either drop your query in the comment box below or connect with Shiksha Study Abroad Counsellors.

University of Lancashire accepts country-specific qualifications from overseas applicants. Indian candidates who wish to pursue their higher studies from the university, must meet the University of Lancashire admission requirements for Indian students listed below:

Undergraduate Requirements:

- Higher secondary school certificate

- Overall score of 60% (80% for excellence scholarship)

- 60% - 70% in Standard XII English (IELTS 6.0 equivalent)

Graduate Requirements:

- Bachelor's or Master's degree in relevant field;

- Overall score of 58% in bachelor's degree (80% for excellence scholarship) or 55% in master's degree

- 65% - 75% in Standard XII English (IELTS 6.5 equivalent)

As an international student, attending the University of Lincoln is a very fun experience. Lincoln University offers exceptional academic programs for their students. Also, the faculty of the university is very qualified and have an expertise in their fields. Students really enjoy the campus library as well as the services and facilities offered by the university. Additionally, the environment for foreign students in very welcoming and friendly.

Pick your stage and get free guidance from counsellors who've helped thousands get into top universities.

Starting research

Starting research Shortlisting colleges

Shortlisting colleges Exam preparation

Exam preparation SOP/LOR writing

SOP/LOR writing Scholarship & finance

Scholarship & finance Visa application

Visa application

With proper planning and hard work, students can easily clear the UK 10th board exam.