How Students Are Paying for Study Abroad in 2025 [Insights from 1,630 Students]

Studying abroad on a scholarship seems like an attractive solution to fund your education, especially when you don’t have to repay the amount awarded to you. But what if you run out of the scholarship deadlines or don’t get shortlisted for one? This article highlights the preferred mode of financing education abroad by Indian students by means of a poll conducted by Shiksha Study Abroad.

Every year, prestigious colleges abroad increase their tuition fee for international candidates. The amount further increases as the student transitions to a higher semester in their course. Hence, the cost of studying abroad has become a major concern for students nowadays. In a recent poll by Shiksha Study Abroad, more than 1500+ students participated and shared their preferred method of paying for their abroad education. In this poll with 1,630 respondents, an overwhelming 85% chose “Scholarships” as their primary mode of funding. That’s not just a preference—it’s a survival strategy. Read this article to gain insights from one of the latest polls conducted by Shiksha. You may expect to expand your knowledge of the available financial aids for studying abroad. Additionally, you will learn the possible reasons, benefits and setbacks behind each choice.

Also, Check:

| Study in UK | Study in USA | Study in Canada |

| Study in France | Study in Germany | Study in Australia |

- Preferred Mode of Funding Abroad Education by Indian Students: Poll

- Insights from the 85% Scholarship Preference

- Breakdown of Insights Drawn from Other Financing Options

- Strategies to Secure Financial Aid to Study Abroad

- Other Modes of Finance for Indian Students

Preferred Mode of Funding Abroad Education by Indian Students: Poll

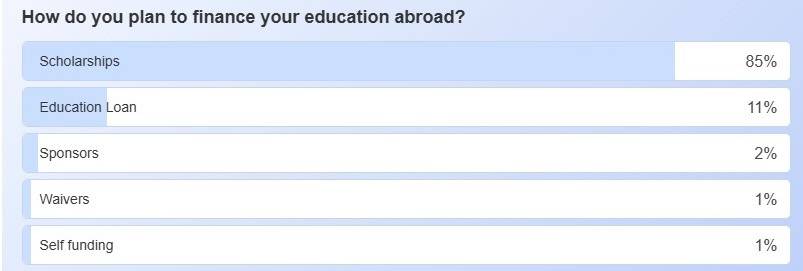

Here are the poll results in which over 1600+ students shared their responses on what is their preferred mode of funding abroad education:

| Funding Method |

% of Votes |

Actual Voter Count |

|---|---|---|

| 🎓 Scholarships |

85% |

1,386 |

| 💳 Education Loan |

11% |

179 |

| 🤝 Sponsors |

2% |

33 |

| 📜 Waivers |

1% |

16 |

| 💼 Self-funding |

1% |

16 |

Also Read:

| Scholarships to Study in UK | Scholarships to Study in USA | Scholarships to Study in Canada |

| Scholarships to Study in France | Scholarships to Study in Germany | Scholarships to Study in Australia |

Insights from the 85% Scholarship Preference

Here are the deep-dived insights drawn about the choice of scholarships as financial aid by Indian students in the poll:

- The Need for Scholarships: Education costs abroad (tuition + living) average at $25,000–$70,000/year. Based on the length of most bachelor’s and master’s courses, if you multiply this amount by a 2-year or 4-year program, you usually end up staring at a six-figure debt. Check how to study abroad for free from India.

- High Financial Need: A very high percentage of students looking for a funding opportunity indicates that a vast majority of Indian students aspiring to study abroad are highly reliant on financial aid to make their dreams a reality. It indicates that self-funding or other means might be less accessible or feasible for most students.

- Awareness: A high number of students opting for scholarships also implies that they are aware of the scholarship options available to them, along with the benefits of availing of a scholarship to study abroad. Check: Fully-funded Scholarships to Study Abroad

- Highly Competitive Nature of the Scholarships: More students opting for a limited number of available scholarships also means that the competition to get a scholarship must be intense.

- Potential Deterrent for Others: With 85% of students choosing scholarships and only 15% of students choosing other modes of funding their education abroad, it can be implied that some students are discouraged by the competitive nature of scholarships and are exploring alternatives.

- Focus on Merit: Since scholarships are primarily merit-based (with some of them being need-based scholarships), students must focus on achieving high merits to improve their chances. Read: Need-Based vs Merit-Based Scholarships

Conclusion: Since scholarships need not be repaid, if available, these are the only risk-free options to access quality education abroad.

Check: What Kind of Student Profile is Required to Win a Scholarship?

Predict your IELTS, TOEFL, and PTE in just 4 steps!

Breakdown of Insights Drawn from Other Financing Options

Here is the inference drawn from the choices made by study-abroad aspirants apart from scholarships:

1. Education Loans as the Next Option: Despite the wide availability of education loans to study abroad, only 11% of the respondents rely on them. There may be many reasons for students not choosing education loans as a preferred method of funding their education. Most of them generally relate to the uncertainty of repayment. Additionally, interest rates for international education loans can hit 10–14%, compounded annually, which further increases the overall loan amount.

It’s a common consideration among students that the high amounts of loan can be repaid with the help of jobs abroad as the companies pay hefty amounts outside of India, based on the strength of local currency. Hence, the following can be the major concerns in getting jobs and not being able to repay the loan amount:

- Post-degree risk of unemployment

- Work visa issues

- Economic downturns

- Currency fluctuations.

Check: Education Loan Repayment: Tips to Pay Student Loan Faster

2. Limited Reliance on Other Sources: The remaining options – Sponsors (2%), Waivers (1%), and Self-funding (1%) – collectively account for a very small percentage. This highlights that these are either less accessible, less common, or perhaps less desirable primary funding sources for the majority of students. The possible reasons behind the lesser popularity of the remaining funding options include:

- Sponsors: This could include family members beyond immediate parents, employers, or other organisations. Some employers may offer to fund your abroad education in exchange of services after completing your degree. This may be found prevalent in situations when an aspirant, already on a job, seeks education abroad and the course opted by them may be of significant importance to the team or company. The low percentage suggests this is not a widely popular and/or available option. Additionally, one is required to have elite connections to find a sponsor for their education abroad. Check out the tips to finance your education abroad.

- Waivers: This likely refers to tuition fee waivers, which might be specific to certain programs or universities or based on specific criteria. The tuition fee waivers are often misunderstood, as they only waive the amount of tuition and not other components of the academic fee. Also, waivers are only available for high-merit on a case-by-case basis or under exchange programs. The very low percentage indicates limited applicability or awareness.

- Self-funding: This kind of funding comes straight from the personal savings or business of the aspirant. The minimal 1% for self-funding underscores the financial constraints faced by most Indian students aspiring to study abroad. This kind of funding is found to be rare and usually comes from high-net-worth families.

Also Read:

| Education Loan to Study in UK | Education Loan to Study in USA | Student Loan to Study in Canada |

| Student Loan to Study in France | Student Loan to Study in Germany | Education Loan to Study in Australia |

Strategies to Secure Financial Aid to Study Abroad

Now that we have gone through the possible reasons why Indian students prefer the choices as per the poll results, let us look at the best measures to help you secure any one of the above-discussed funding options.

| Goal |

Strategy |

|---|---|

| Maximise scholarship chances |

Start 12–18 months early. Keep an eye on international scholarships like DAAD, JASSO, MEXT, Erasmus, GREAT and Commonwealth scholarships |

| Get real sponsorship |

Build a LinkedIn presence; reach out to alumni and get in touch with your employer and discuss your aim of upskilling by means of going to study abroad and ask if the company could help you financially. |

| Waivers |

If you need a tuition fee waiver, you must express the same in your college application. The college/university will then grant you one based on your application. |

Just so you know, while you look for funding aid, please make sure you avoid any suspected scams. Don’t invest in resources or pay allegedly to people who claim to get you an internship or other such advantageous scheme. For education loans, consult your regional bank office directly and don’t offer any personal information and documents to any person who claims to help you outside of the official procedures.

Also Read: How to Study Abroad in 2025?

Other Modes of Finance for Indian Students

Indian students can also explore the following modes for financing their studies:

- Corporate Sponsorships: Some companies sponsor employees or talented individuals for higher education abroad, especially in fields relevant to their business.

- Crowdfunding: Platforms exist where individuals can raise funds for their education from a wider network.

- Bartering or Exchange Programs: Institutions have exchange programs with partial funding or waived tuition fees.

- Government Schemes: The Indian government offers various schemes and financial assistance for students pursuing higher education, including those going abroad. Students should research these options.

This was all about the preferred funding options by Indian students going to study abroad. For more information, you can reach out to Shiksha’s Counselling Services for free.

Explore popular universities

Pick your stage and get free guidance from counsellors who've helped thousands get into top universities.

Starting research

Starting research Shortlisting colleges

Shortlisting colleges Exam preparation

Exam preparation SOP/LOR writing

SOP/LOR writing Scholarship & finance

Scholarship & finance Visa application

Visa application