How to Become a Financial Manager? Qualifications, Skills & Certifications

Interested in becoming a financial manager? Read this article to learn about the career path to follow to become a financial manager. Know the qualifications, certifications, and skills required to become a financial manager.

What are the steps to become a financial manager? Financial Managers are among the most in-demand professionals, and companies are always looking for skilled experts to look after their financial health and lead their financial strategies. With the right education, experience, skills, and mindset, students can become financial managers.

In today’s dynamic environment, financial managers play a crucial role in guiding a company towards growth and financial stability. They help in budgeting, financial planning, risk management, and investment decisions of a company.

Read this article to know the job responsibilities of a financial manager and a step-by-step guide to becoming a financial manager. Know the educational qualifications and certifications required for a financial manager. Also, know what skills and qualities will help build a career as a financial manager.

- Who is a Financial Manager?

- How to Become a Financial Manager?

- Qualifications Required to Become a Financial Manager

- Skills of a Financial Manager

Who is a Financial Manager?

A financial manager of a company/organization oversees its financial health by preparing and analyzing the financial statements, developing budgets, handling taxes, and monitoring the cash flow of the company. The basic aim of a financial manager is to ensure that the company is compliant to the financial regulations and help provide fair and accurate finances. Apart from this, a financial manager also offers advice to senior management of the firm regarding investments, risk management, and strategies to maximize the company’s profit.

Key Responsibilities of a Financial Manager

Below are some of the major responsibilities a financial manager has to perform:

- Produce internal and external financial reports

- Research market trends and competition to assess growth opportunities

- Manage investments & optimize allocation of funds

- Ensure adherence to tax laws and financial regulations

- Leads the finance team and coordinates with the auditors

- Identify risks to frame mitigation strategies

How to Become a Financial Manager?

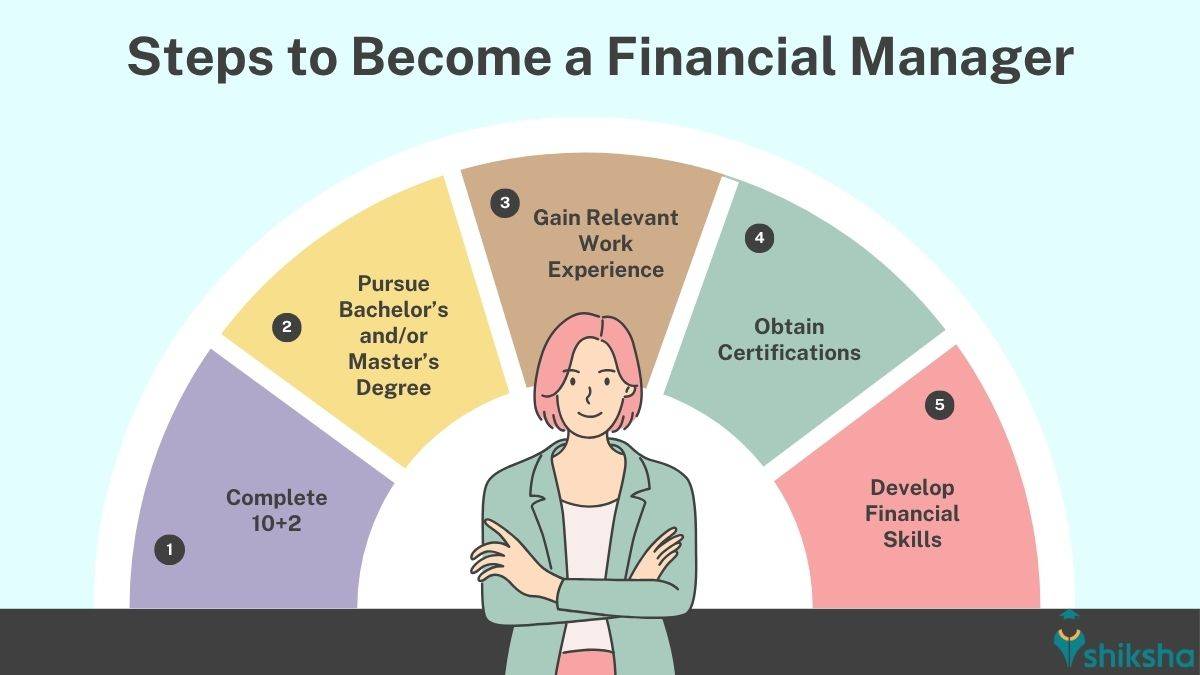

Follow these steps to become a financial manager:

1. Employers usually give first preference to candidates with a commerce background in 10+2 in finance or economics. So, the first step towards becoming a financial manager is to opt for the Commerce Stream with subjects like economics, mathematics, accountancy, and business studies, and obtain good marks for further admissions. Studying these subjects will help gain the basic knowledge required for the job role of a financial manager.

2. After completing 10+2, pursue a relevant bachelor’s degree. Companies usually prefer candidates who have completed an undergraduate course in accounting, economics, or finance-related specializations. For this, gain admission to a UG course such as the Bachelor of Commerce (B.Com.), Bachelor of Business Administration (BBA), Bachelor of Economics, Bachelor of Arts (BA) in finance fields, or a professional degree such as CA, CFA, etc.

Companies hire candidates based on a bachelor’s degree, but a candidate with a master’s degree has a better chance of securing the job. Therefore, after gaining a bachelor’s degree, pursue a relevant master’s degree such as Master of Business Administration (MBA) or Master of Commerce (M.Com.) in finance-related specialization.

3. To gain first-hand practical experience of the theoretical knowledge provided in the bachelor’s degree, students can apply for an internship during their three or four-year Bachelor’s Degree. An internship can give a good experience and an introduction to the financial world of a company. Besides, companies usually offer a full-time job to their interns once their undergraduate degree is completed. Also, if a student is aiming for another company, having an internship experience on the resume looks good and increases the chances of securing the job.

4. Even though companies do not list certifications as a basic requirement for the role of a finance manager, having a professional certification gives candidates a competitive edge and makes them more desirable to employers. Having a professional certificate not only helps in securing promotions or landing the desired job role but also enhances subject knowledge and strengthens the resume.

5. Pursuing a required UG or PG course and/or obtaining a professional certification alone cannot guarantee a job as a financial manager. While gaining experience in entry-level or middle-level positions, candidates must continuously refine their financial skills to be able to handle the increased responsibilities that come with the role of a financial manager.

Qualifications Required to Become a Financial Manager

Each company has different qualification requirements based on the job description, level of seniority, and nature of the company. However, companies usually ask for the following educational qualifications for the role of a financial manager:

Undergraduate Degree

Having a bachelor’s degree is generally the minimum requirement of a company for the job of a financial manager. Although there are no restrictions on specialization, having a bachelor’s degree in fields such as accounting, finance, economics, business administration, or other finance-related fields is beneficial.

Postgraduate Degree

A bachelor’s degree is enough to become a financial manager. Having a master’s degree, such as an MBA in Finance or a Master’s in Financial Management, can help get a senior level job. A master’s degree not only provides financial knowledge but also improves one’s leadership and decision-making skills.

Certifications

Employers do not mandate having certifications for the position of a financial manager. However, having an appropriate professional certificate increases the chances of securing a job or promotion. Below is the list of top certifications one can obtain:

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Financial Risk Manager (FRM)

- Certified Management Accountant (CMA)

- Certified Financial Planner (CFP)

- Chartered Accountant (CA)

- Certified Fund Specialist (CFS)

- Certified Investment Management Analyst (CIMA)

- Chartered Investment Counsellor (CIC)

Each of these professional courses has different eligibility requirements. Before deciding which certification to pursue, candidates are advised to gain complete information on them.

Also Read: Finance Manager Online Courses & Certifications

Relevant Work Experience

For entry-level positions in the field of finance, students are required to meet the educational qualification only. However, for the role of a Financial Manager, employers typically hire a candidate with 5+ years of experience in roles like accountant, budget analyst, financial auditor, financial advisor, insurance claim adjuster, financial analyst, etc.

Skills of a Financial Manager

Apart from educational qualifications and work experience, employers look for certain skills in a candidate required to handle the role of a financial manager. Check out to know about the skills of a financial manager:

| Skills of a Financial Manager | |

|---|---|

| Analytical Skills | Risk Management |

| Understanding of Financial Rules & Regulations | IT Skills |

| Leadership Skills | Communication Skills |

| Problem-solving Skills | Interpersonal Skills |

| Mathematical Proficiency | Attention to Detail |

Also Read:

Call 8585951111

Call 8585951111

Nupur Jain started with a passion for educational content writing, which soon grew into a meaningful journey of helping students through reliable guidance. A commerce graduate from Delhi University, she has spent ov

Read Full Bio