CFA 2026 exam pattern: CFA exam is a series of three challenging levels for investment and banking professionals. The CFA Level 1 exam mainly has MCQs, and the Level 2 and Level 3 includes MCQ questions as well as scenario based questions or item sets. Chartered Financial Analyst exam pattern 2026 is prescribed by the CFA Institute. The CFA exam 2026 will be conducted in the CBT test mode. Earlier, the exam was conducted in the paper based test mode, but, from 2021 onwards, the exam has been conducted in the CBT mode. Each level of the CFA exam has a different exam structure and the difficulty level rises as the level does. Read on to know the detailed CFA exam pattern 2026.

Also Read:

- CFA Exam Pattern 2026 for Level I

- CFA 2026 Exam Pattern for Level II

- CFA 2026 Exam Pattern for Level 3 Exam

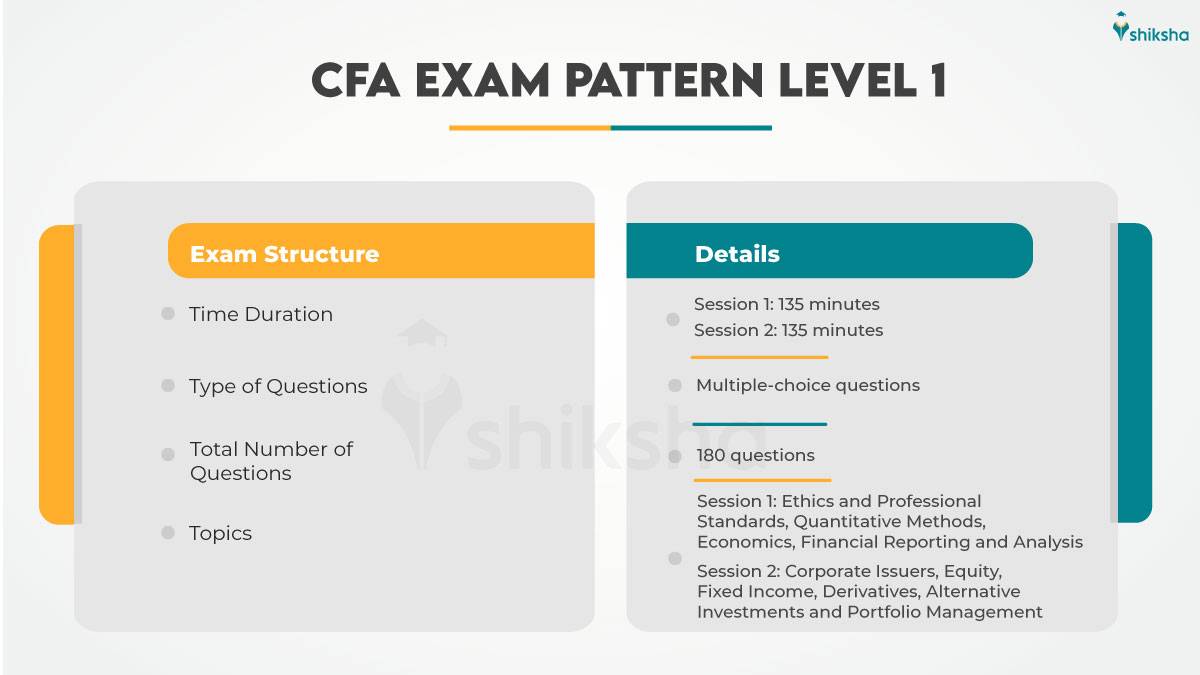

CFA Exam Pattern 2026 for Level I

The Level I exam as per the CFA exam pattern has 180 MCQs. The test is divided into two sessions, each session is held for 135 minutes. It is mandatory for the students to appear in both sessions.

- Morning session is of two hours and 15 minutes in which the students have to solve 90 MCQs.

- Afternoon session is of two hours and 15 minutes in which they have to solve the remaining 90 MCQs. Each question carries the same weightage and there is no negative marking for a wrong answer.

- First session of the exam will be based on topics such as Ethics and Professional Standards, Quantitative Methods, Economics, Financial Reporting and Analysis

- Second session of the exam will be based on topics such as Corporate Issuers, Equity, Fixed Income, Derivatives, Alternative Investments and Portfolio Management

CFA Level I Marking Scheme

Check the table below to know the marking scheme for the CFA 2026 Level I exam:

| Topics | Weightage |

|---|---|

| Ethics and Professional Standards | 15%- 20% |

| Quantitative Methods | 6%- 9% |

| Economics | 6%- 9% |

| Financial Reporting and Analysis | 11%- 14% |

| Corporate Finance | 6%- 9% |

| Portfolio Management | 8%- 12% |

| Equity Investment | 11%- 14% |

| Fixed Income | 11%- 14% |

| Derivatives | 5%- 8% |

| Alternative Investments | 7%- 10% |

Also Read:

CFA 2026 Exam Pattern for Level II

Level II of the CFA exam will have item set questions which will be comprised of vignettes. The test will be conducted in two sessions - morning and afternoon. The total duration of the exam will be 4 hours and 24 minutes which will be divided into two sessions.

- Each question is of three points with no penalty for wrong answers

- Each session will be conducted for 2 hours and 12 minutes

- Each set will be followed by four or six MCQs

- Each session will have 44 multiple-choice questions

Level 2 CFA exam is standardized with 11 item sets for each session, hence the total number of sets is 22 on the exam. 20 questions of these 22 will be scored and two questions will not be scored as they are on the trial by the CFA institute. The CFA Level II exam consists of 22 item sets comprised of vignettes with 88 accompanying multiple-choice questions.

The CFA topics areas will be placed randomly and all the topics of the CFA exam will be covered. Each item vignette will begin with a statement of the topic and total point value. For instance:

Topic: QUANTITATIVE METHODS

Total Points Value of this Question set is 12 points

Also Read: How hard is the CFA exam?

Commonly asked questions

CFA Level 2 format is unique as compared to other levels:

- CFA Level II has item sets, known as vignettes which checks students abilities to apply knowledge rather than just recall facts and definitions.

- Exam will be conducted in morning and afternoon sessions.

- Each session will be for 2 hours and 12 minutes, with an optional break.

- Each set will have 4 or 6 MCQs.

- Total duration will be 4 hours and 24 minutes

- Level II CFA exam includes 21 item sets in total.

- Level II exam builds upon knowledge tested in Level I. It focuses on application of that knowledge to specific real world scenarios

The Level II curriculum for the CFA exam has not changed much. It has gone through the same review to improve the instructional design, all current topics have been maintained. The Level III candidates will have the opportunity to choose to be tested on a specialization. The core of the curriculum will remain the same, but candidates will have the opportunity to focus a percentage of their Level III effort on one of three specialised paths: portfolio management, private markets, or private wealth management.

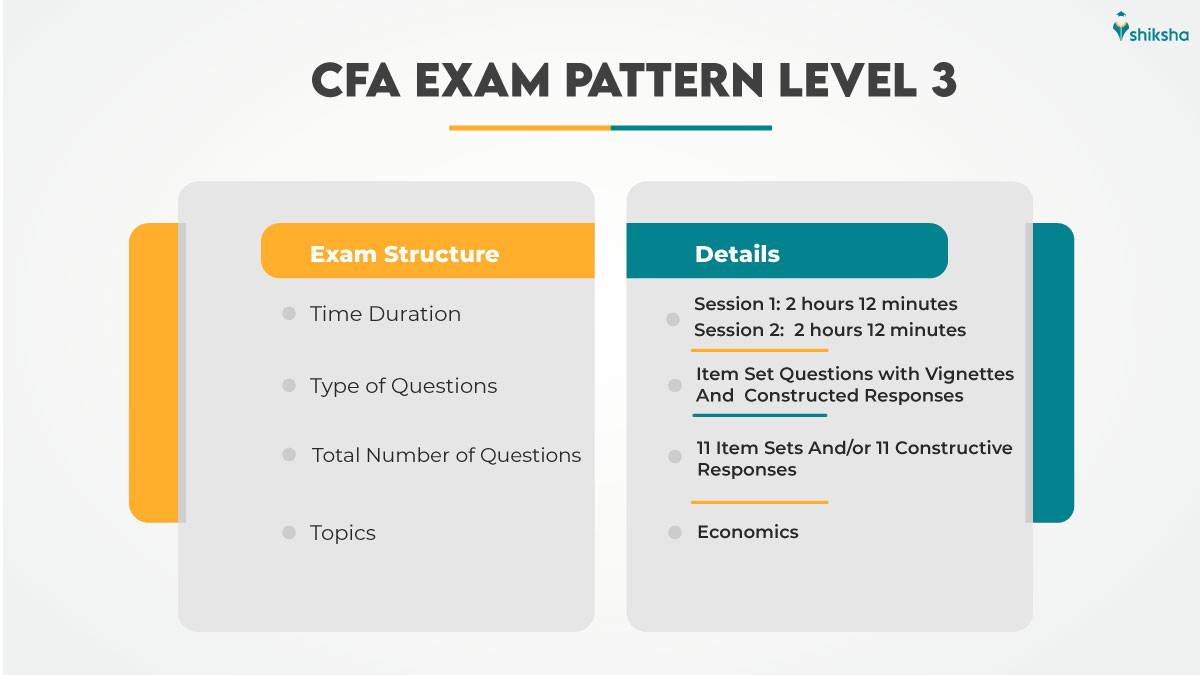

CFA 2026 Exam Pattern for Level 3 Exam

Like the Level II exam, Level III exam will also have item set questions which will be comprised of vignettes. The CFA level 3 exam will also have constructed responses (essays) sets. The exam will be conducted in two sessions. The total duration of the Level III exam will also be 4 hours and 24 minutes. This will be divided equally into two sessions.

- Level III consists of item sets and essay-type questions

- Morning session: Constructed response (essay) questions

- Each session will be conducted for 2 hours and 12 minutes with an optional break in between

- All the questions are mandatory

Candidates need to refer the vignette before answering each item. Each session will have either six item sets and five constructed responses. Overall the Level 3 exam consists of 11 item sets and 11 essay sets for 12 points each. Like the Level 2 CFA exam, each vignette in the Level 3 exam will also begin with a statement of the topic and total point value which will always be 12 points. For instance:

Topic: ECONOMICS

Total Point Value of this question set is 12 Points

Read More:

CFA Exam Exam

Student Forum

Answered 2 weeks ago

Angoff Method is used by subject matter experts to decide probability of a student answering each question correctly in CFA exam. These probabilities range from 0 to 100 and are then averaged for each question. Then the averages are added to find the final cutoff or minimum passing score in CFA exam

R

Beginner-Level 5

Answered 2 weeks ago

Name of Books | Authors |

|---|---|

Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions | Pearl and Rosenbaum |

2021 CFA Level I | Kaplan Schweser |

Strategic Value Investing: Practical Techniques of Leading Value Investors | Stephen M. Horan, Robert R. Johnson and Thomas R. Robinson |

When Genius Failed: The Rise and Fall of Long-Term Capital Management | Roger Lowenstein |

The Cartoon Guide to Statistics | Larry Gonick and Woollcott Smith |

CFA Level I | Bhupesh Ananad |

The Handbook of Fixed Income Securities | Frank J. Fabozzi |

Answered a month ago

CFA programme is a rigorous one. Students should have a good preparation plan to clear CFA Level 2 exam. Students should devote at least 300 hours on an average for each level of the CFA exam

R

Beginner-Level 5

Answered a month ago

- Open CFA website

- Login to CFA account

- Select CFA program

- Proceed past initial scheduling tools

- Search by preferred city.

- Select a date range. Students should choose a wide date range

M

Beginner-Level 5

Exam On - 29 Jan '26 - 2 Feb '26

Exam On - 29 Jan '26 - 2 Feb '26

What is the Angoff Method in CFA exam results?