What is IFRS: All About International Financial Reporting Standards

Jaya SharmaAssistant Manager - Content

The full form of IFRS is International Financial Reporting Standards. These accounting standards are issued by both the IFRS Foundation and the International Accounting Standards Board (IASB). IFRS constitute a standardised way to describe a company's financial performance. Its aim is to ensure that the financial statements are understandable and comparable anywhere in the world. IFRS is relevant for companies that have publicly listed shares and securities. In the United States, GAAP is still followed.

What are IFRS?

International Financial Reporting Standards (IFRS) are the set of accounting rules used in the financial statements of public companies. By following IFRS, companies can prepare financial statements that are comparable, transparent and consistent.

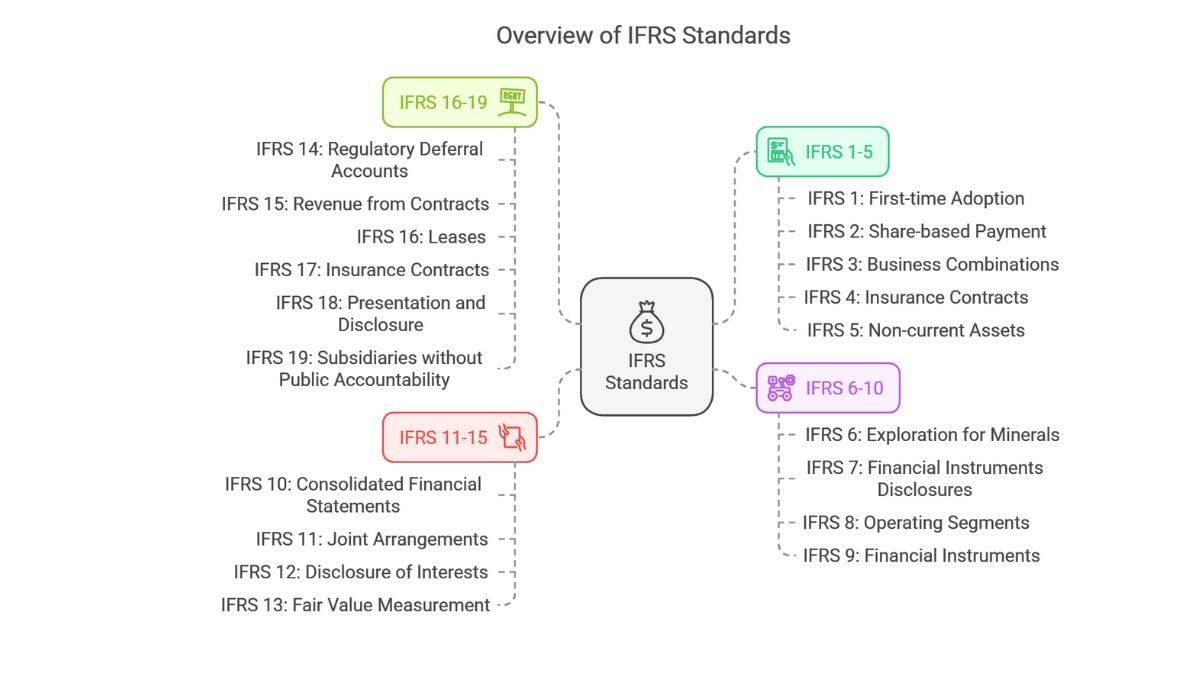

List of IFRS Standards

The following IFRS standards are stated on the official website and are as mentioned below:

From 1st January 2027, IFRS 18 will supersede IAS 1. This means that IAS 1 will no longer remain effective. For now, IAS 1 is not the same as IFRS.

- What are The Benefits of Learning IFRS Standards?

- Who Can Learn IFRS Standards?

- How To Become Certified in IFRS Standards?

- Online Courses To Learn IFRS Standards in Detail

- Popular IFRS Colleges in India

- Popular Private IFRS Colleges in India

- Popular IFRS Specializations

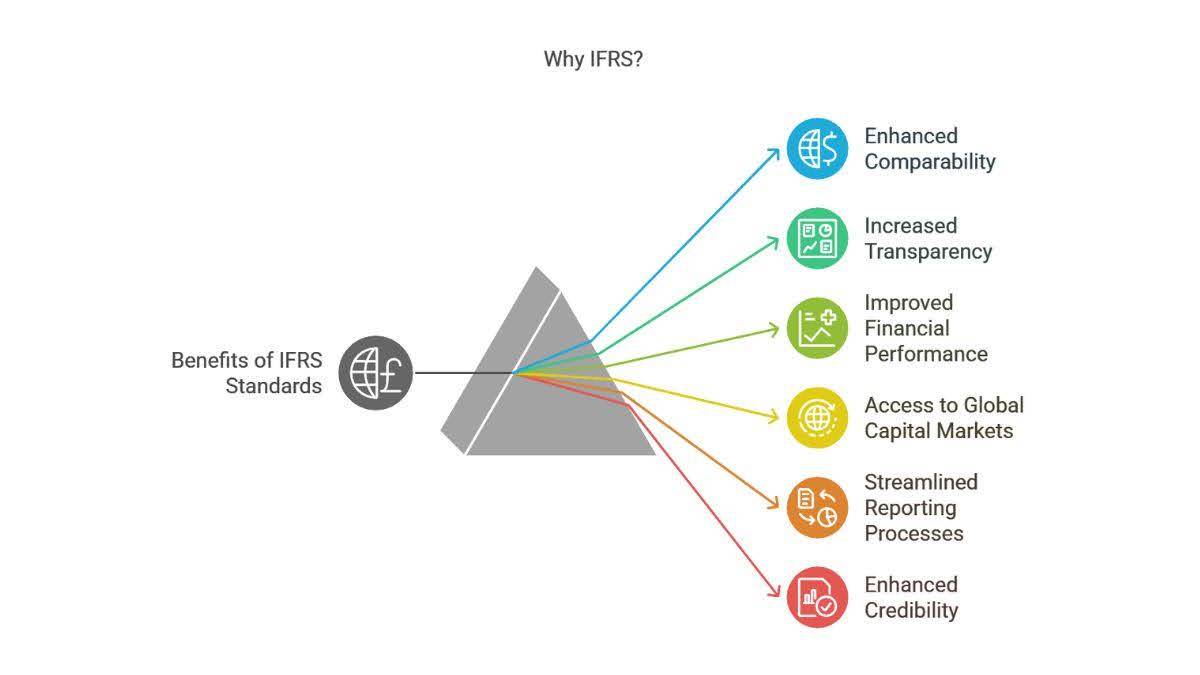

What are The Benefits of Learning IFRS Standards?

The below mentioned points tell the benefits of IFRS standards:

- Finance professionals who know IFRS can work in foreign countries, as they're accepted and used in over 140 countries globally.

- Those who have the knowledge of IFRS can compare and analyze financial statements from companies worldwide as these standards create a common finance language.

- People who master IFRS standards often have a higher salaries and have access to more senior positions, mostly in multinational companies and international accounting firms where IFRS expertise is highly valued and increasingly necessary.

Knowledge of IFRS is particularly valuable for investment analysts, accountants, and business consultants who need to evaluate companies across different jurisdictions.

Who Can Learn IFRS Standards?

Anyone interested in building a career in the Accounting and Finance domains can learn International Financial Reporting Standards (IFRS). The following people are qualified :

|

Category |

Who Should Learn |

|

Educational Qualification |

|

|

Professional Accountants |

|

|

Industry Practitioners |

|

|

Experience-Based Learners |

|

'Statement of Financial Position' is the balance sheet format used in IFRS. It first presents non-current assets which is followed by current assets, equity, non-current liabilities and at last, it presents current liabilities.

How To Become Certified in IFRS Standards?

Those who want to become certified professionals with the knowledge of IFRS, need to get an FSA credential. By clearing this two-part credential, professionals will be able to integrate sustainability considerations into financial analysis. This will prepare you to lead on disclosure. By getting an FSA credential, a professional will be able to understand how sustainability and financial performance interlink. They will learn to navigate through the complexities of modern business.

1. The FSA Credential Level I exam

This is a 2-hour long exam that consists of 110 MCQs. The following table covers the syllabus of the exam:

|

Part |

Sections |

Topics |

|

Part I: The Need for Sustainability Disclosure Standards |

1. Demand for sustainability information |

|

|

2. The historical basis for disclosure |

|

|

|

3. Materiality: a guiding principle for required disclosure |

|

|

|

4. The limitations of financial disclosure |

|

|

|

Part II: The Sustainability Information Ecosystem |

5. Introduction to the sustainability information value chain and the role of data providers |

|

|

6. The role of standards and frameworks: from fragmentation to cohesion in sustainability disclosure |

|

|

|

7. Materiality: going beyond investors |

|

|

|

8. Sustainability disclosure across jurisdictions |

|

|

|

Part III: Understanding IFRS Sustainability Disclosure Standards |

9. What is useful sustainability-related financial information? |

|

|

10. The IFRS Sustainability Disclosure Standards |

|

|

|

11. Setting IFRS Sustainability Disclosure Standards |

|

|

|

12. How companies disclose sustainability-related financial information |

|

|

|

Part IV: Corporate and Investor Use: Going Beyond Disclosure |

13. A closer look: investor demand for sustainability information |

|

|

14. Considerations for corporate use |

|

|

|

15. Considerations for investor use |

|

2. FSA Credential Level II Exam

The level II FSA credential examination which is 2 hours long and consists of 55 MCQs related to 13 miniature case studies. Those who are sitting for the level II exam need to understand that the exam test the candidate's ability to analyse the sustainability performance of the company using quantitative and qualitative financial and sustainability data. The following table provides the complete syllabus of the exam:

|

Part |

Topic |

|

Part I: Identifying the Sustainability Issues Relevant to Financial Performance |

|

|

How a Company’s Circumstances Influence Material Sustainability Issues |

|

|

Understanding Sustainability Issues |

|

|

Evaluating Sustainability Issues |

|

|

Part II: Evaluating the Comparability of Sustainability Information |

|

|

Normalizing Data for More Effective Comparisons |

|

|

Analyzing the Spread of Industry Performance |

|

|

Considering Company-Specific Context |

|

|

Part III: The Connection Between Sustainability Performance and Valuation |

|

|

Characterizing Financial Impact |

|

|

Using Sustainability Data in Financial Valuation |

|

|

Integrating ESG Beyond DCF |

|

Currently, there are 17 IFRS standards in application. By 1st January 2027, IFRS 18 and 19 will also be in application.

Online Courses To Learn IFRS Standards in Detail

The following online courses are relevant for those who want to learn about IFRS standards in detail:

| Course | About the Course |

| IFRS - International Financial Reporting Standards | In this course, the set of accounting standards IFRS are discussed that govern how different types of transactions and events should be reported in the financial statements. |

| Certificate in IFRS | This course is suitable for finance professionals who want to understand the structure of the IFRS framework. Through this course, the students will learn to apply relevant financial reporting standards to important elements of financial reports. They will also learn to identify and apply disclosure requirement for companies in the financial reports. |

| Diploma in International Financial Reporting (DipIFR) | Professionals who have enrolled in this course will understand the conceptual framework of financial reporting and learn to apply them. They will also learn to prepare group financial statements including subsidiaries, associates and joint arrangements. Group cash flow statements are not included. |

Popular IFRS Colleges in India

#11 Outlook

#6 India Today

Accounting & Commerce Applications open. Apply Now

Popular Private IFRS Colleges in India

Accounting & Commerce Applications open. Apply Now

Accounting & Commerce Applications open. Apply Now

Popular IFRS Specializations

Popular Specializations

- IFRS

1 College

News & Updates

Student Forum

Answered Yesterday

Candidates must Bachelor's degree in Commerce or Business Administration with at least 45% aggregate or, BCom (Hons) with at least 45% aggregate or, graduation with Honours in Economics or Mathematics/ Statistics/ Commerce with at least 45% aggregate to apply for MCom at Sri Aurobindo College of C

N

Guide-Level 15

Answered Yesterday

Aspirants must pass Class 12 from a recognised board to apply for BCom programme at Sri Aurobindo College of Commerce and Management. Candidates are selected for BCom programme based on their scores in the qualifying exam.

N

Guide-Level 15

Answered Yesterday

The total tuition fees for BCom is INR 2.6 lakh at Sri Aurobindo College of Commerce and Management. Selected candidates need to pay the course fees to confirm their seat. The fees can be paid via any of the online payment modes.

N

Guide-Level 15

Answered Yesterday

Candidates are offered admission in MCom based on their merit. Aspirants do not have to pass any entrance exam for admission at Sri Aurobindo College of Commerce and Management. Candidates need to meet the eligibility for admission.

N

Guide-Level 15

Answered Yesterday

Sri Aurobindo College of Commerce and Management has 40 seats in MCom programme. Aspirants are offered seat in MCom based on their merit. The college considers qualifying exam scores of the candidats for admission.

N

Guide-Level 15

Answered Yesterday

No, there is no age limit to take the CFA Level 3 exam. However, students should have completed their graduation and fulfil other exam criteria.

N

Contributor-Level 6

Answered Yesterday

The following are the instructions for CFA exam admit card:

- The details mentioned on the admit card should be correct

- Arrive the exam centre at least an hour before the exam

- The details should march the ones mentioned in the passport

If any of the information mentioned above needs to be corrected or upd

R

Contributor-Level 6

Answered Yesterday

The table below shows the top CUET accepting BCom colleges in Mumbai (All) with their tuition fees -

| Top Colleges | Tuition Fee |

|---|---|

| Narsee Monjee College of Commerce & Economics | INR 3.16 lakh |

| Chhatrapati Shivaji Maharaj University | INR 90,000 - INR 1.25 lakh |

| Dr. Shantilal K Somaiya School of Commerce and Business Studies | INR 6 Lacs - INR 8 lakh |

| FinX Institute | INR 4.63 lakh |

Source: Official site and may vary.

T

Contributor-Level 10

Answered Yesterday

Generally private colleges are expensive than government colleges as they hace modern infrastructure with modern labs and classrooms, hostel facilities, experienced faculty and offer great placement options in top companies. However, some affordable options are also available which are mentioned bel

T

Contributor-Level 10

Answered Yesterday

As per the popularity basis by the top BCom colleges in Mumbai (All), listed below are some of the top colleges with tuition fees -

| Top BCom Colleges | Tuition Fee |

|---|---|

| Narsee Monjee College of Commerce & Economics | INR 43,410 - INR 3.82 lakh |

| Mithibai College of Arts | INR 39,000 - INR 3.5 lakh |

| St. Xavier's College, Mumbai | INR 2 Lacs - INR 2.02 lakh |

| K J Somaiya College of Arts and Commerce | INR 48,030 |

| Kishinchand Chellaram College | INR 1.51 lakh |

Source: Official site and may vary.

T

Contributor-Level 10

Answered 2 days ago

Yes, students looking to get admission into BCom course can make payment via online methods. They can pay through Net Banking, UPI, Demand draft in the name of college, and more. In case of any issues regarding the fee payment, student can visit the college campus for clarification.

C

Contributor-Level 10

Answered 2 days ago

Application for BCom course can be made online at the college website. The students who wish to apply for the BCom course at MML College of Commerce, must follow these steps:

1. Students must visit the MMK College website and select the BCom course

2. Then, fill the application form and pre-enrolment

C

Contributor-Level 10

Answered 2 days ago

The total seat intake for BCom course varies every year. There are no fixed number of seats offered in BCom programme at MK College of Commerce. The students must check the college website and admission brochure for more details. In case of any doubts, they can reach out to admission team for quick

C

Contributor-Level 10

Answered 2 days ago

Yes, the BCom course is offered in affiliation with Mumbai University. The college is autonomous and was granted this status by the UGC. MMK College of Commerce has its own BCom curriculum. It is accredited by NAAC.

C

Contributor-Level 10

Answered 2 days ago

Students get to learn various skillsets after completing their BCom course at MMK College of Commerce. They learn business communication, statistics, advanced mathematics, and more. This helps them build strong foundations for their career. The course curriulum is defined in a manner which provides

C

Contributor-Level 10

Answered 2 days ago

Some of the subjects offered in BCom course at MMK College of Commerce are:

1. Foundational courses part two

2. Accountancy and Financial Management part two

3. Business Communication

4. Mathematical and Statistical techniques

C

Contributor-Level 10

Answered 2 days ago

The course curriculum consists of various subjects like Accountancy and Financial Management, Business Economics, Business Law, Marketing Management and more. The students get to learn theory as well as practical skills. Faculty is well-qualified and makes learning more interesting for students. Cou

C

Contributor-Level 10

Answered 2 days ago

The placement cell provides regular training to the students. It helps them in building technical as well as soft skills. Students get the latest updates about the industry which helps them during final placements. It plays a major role in inviting reputable companies to the campus for placements.

C

Contributor-Level 10

Answered 2 days ago

Application for BCom course can be made online at the college website. The students who wish to apply for the BCom course at MML College of Commerce, must follow these steps:

1. Students must visit the MMK College website and select the BCom course

2. Then, fill the application form and pre-enrolment

C

Contributor-Level 10

Answered 2 days ago

No, admissions are only done in online mode for BCom course at MMK College of Commerce. The students who wish to apply must fill the application for online. They can visit the college website. Then select the BCom course form the available courses. Application form must be filled carefully. In case

C

Contributor-Level 10

Answered 2 days ago

Yes, students can get direct admission on basis of class 12th exams score. There is no entrance exam for BCom course. On the basis of past scores and academic qualification, students can get admission into MMK College of Commerce and Economics.

C

Contributor-Level 10

Answered 2 days ago

The last date to apply is not out on the college website. In case of any updates, students will be communicated details for the same. They must keep checking the website regularly. In case of any problems, they can contact the admissions department.

C

Contributor-Level 10

Answered 2 days ago

No, MMK college of commerce and economics does not have any entrance based exam. The admissions are given on the basis of marks obtained in class 12th. Students must apply within the deadline to ensure admission into BCom course. Before making the application, student must fulfil the minimum eligibi

C

Contributor-Level 10

Answered 2 days ago

The dates for BCom admisions have not been released by the college. However, the tentative month for admission is June, 2026. When the dates are released by the college, the same will be updated on their official website. The students must keep checking the website for timely updates.

C

Contributor-Level 10

Answered 2 days ago

Before making the course payment at MMK College of Commerce, student must fulfil the minimum eligibility criteria for admissions. If they are not able to meet the minimum eligibility, the college can withhold the admission. In case of any doubts, students must reach to admissions team for support.

C

Contributor-Level 10

Answered 2 days ago

Yes, students looking to get admission into BCom course can make fee payment via online methods. They can pay through Net Banking, UPI, Demand draft in the name of college, and more. In case of any issues regarding the fee payment, student can visit the college campus for clarification.

C

Contributor-Level 10

Answered 2 days ago

The total fees for BCom course has not been mentioned on the college website. However, as per Shiksha, the total fees are around INR 14,780 per year. However, students looking to get admission into this course, must contact the admissions team for more details. In case of any update on BCom fees, th

C

Contributor-Level 10

Answered 2 days ago

The students looking to get admission into BCom course, must clear class 12th with a recognised board. Academic record of students must be consistent throughout the academic year. They must not have any backlogs in any of the subjects. Students can make their applicstion from the official website of

C

Contributor-Level 10

Answered 4 days ago

The total tuition fees for Bcom course is INR 70,000 every semester. In addition, the college also has some more fee components, which are given below:

1. Sports and unit test fees: INR 1,000

2. Development fee (one-time fee): INR 10,000

3. Special fees, such as medical fee, registration fee (at time o

C

Contributor-Level 10

Answered 4 days ago

SRCC Delhi PG cutoff list 2025 was concluded with the release of the final cutoff list. The cutoff was released for different categories belonging to the AI quota. For the students belonging to the General category under the AI quota, the most competitive course for admission was M.Com, with last ro

P

Contributor-Level 9

Taking an Exam? Selecting a College?

Find insights & recommendations on colleges and exams that you won't find anywhere else

On Shiksha, get access to

- 66k Colleges

- 1k Exams

- 687k Reviews

- 1800k Answers

IFRS is the widely accepted set of accounting standards that are implemented in over 140 countries. GAAP is the generally accepted accounting principles that are accepted in the United States for financial reporting.