The Jharkhand Academic Council has released the JAC 12th Syllabus 2024 for Commerce stream on the official JAC website. It has also been provided below for the reference of students. Students must note that the Jharkhand Board refers NCERT books for preparing its students for the board exams.

- JAC 12th Economics Syllabus 2024

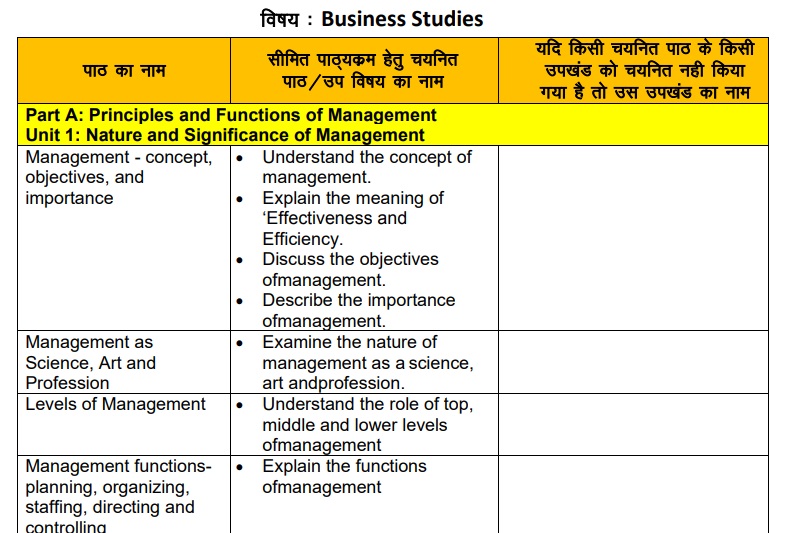

- JAC 12th Syllabus 2024 for Business Studies

- JAC 12th Syllabus 2024 for Accountancy

JAC 12th Economics Syllabus 2024

Students can check below the JAC Class 12 Economics Syllabus 2024

| Part A: Introductory Macroeconomics | |

| Unit 1: National Income and Related Aggregates | What is Macroeconomics? Basic concepts in macroeconomics: consumption goods, capital goods, final goods, intermediate goods; stocks and flows; gross investment and depreciation. Circular flow of income (two-sector model); Methods of calculating National Income - Value Added or Product method, Expenditure method, Income method. Aggregates related to National Income: Gross National Product (GNP), Net National Product (NNP), Gross Domestic Product (GDP) and Net Domestic Product (NDP) - at market price, at factor cost; Real and Nominal GDP GDP Deflator, GDP and Welfare |

| Unit 2: Money and Banking | Money – meaning and functions, supply of money - Currency held by the public and net demand deposits held by commercial banks. Money creation by the commercial banking system. Central bank and its functions (example of the Reserve Bank of India): Bank of issue, Govt. Bank, Banker's Bank, Control of Credit through Bank Rate, Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), Repo Rate and Reverse Repo Rate, Open Market Operations, Margin requirement. |

| Unit 3: Determination of Income and Employment | Aggregate demand and its components. Propensity to consume and propensity to save (average and marginal). Short-run equilibrium output; investment multiplier and its mechanism. Meaning of full employment and involuntary unemployment. Problems of excess demand and deficient demand; measures to correct them - changes in government spending, taxes and money supply. |

| Unit 4: Government Budget and the Economy | Government budget - meaning, objectives and components. Classification of receipts - revenue receipts and capital receipts; Classification of expenditure – revenue expenditure and capital expenditure. Balanced, Surplus and Deficit Budget – measures of government deficit. |

| Unit 5: Balance of Payments | Balance of payments account - meaning and components; Balance of payments – Surplus and Deficit Foreign exchange rate - meaning of fixed and flexible rates and managed floating. Determination of exchange rate in a free market, Merits and demerits of flexible and fixed exchange rate. Managed Floating exchange rate system |

| Part B: Indian Economic Development | |

| Unit 6: Development Experience (1947-90) and Economic Reforms since 1991 | A brief introduction of the state of Indian economy on the eve of independence. Indian economic system and common goals of Five Year Plans. Main features, problems and policies of agriculture (institutional aspects and new agricultural strategy), industry (IPR 1956; SSI – role & importance) and foreign trade. Economic Reforms since 1991: Features and appraisals of liberalisation, globalisation and privatisation (LPG policy); Concepts of demonetization and GST |

| Unit 7: Current challenges facing Indian Economy | Human Capital Formation: How people become resource; Role of human capital in economic development; Growth of Education Sector in India Rural development: Key issues - credit and marketing - role of cooperatives; agricultural diversification; alternative farming - organic farming Employment: Growth and changes in work force participation rate in formal and informal sectors; problems and policies Sustainable Economic Development: Meaning, Effects of Economic Development on Resources and Environment, including global warming |

| Unit 8: Development Experience of India | A comparison with neighbours India and Pakistan India and China Issues: economic growth, population, sectoral development and other Human Development Indicators |

Provided below is the complete JAC Class 12 Syllabus for Economics:

JAC 12th Syllabus 2024 for Business Studies

JAC 12th Syllabus 2024 for Accountancy

Explore subject-wise topics asked in JAC 12th

Select your preferred subject

Explore top Commerce exams

1 Feb '26 - 25 Feb '26 | JEE Main 2026 Registration Ses... |

10 Jan '26 - 20 Feb '26 | MHT CET 2026 Application Form ... |

6 Apr '26 - 2 May '26 | JEE Advanced 2026 registration... |

29 Oct '25 - 15 Apr '26 | AEEE 2026 Phase 2 Registration |

10 Nov '25 - 8 Apr '26 | KIITEE 2026 Registration - Pha... |

2 Feb '26 - 31 Mar '26 | IPU CET 2026 Application Form... |

15 Dec '25 - 16 Mar '26 | BITSAT 2026 Application Form S... |

24 Oct '25 - 31 Mar '26 | VITEEE 2026 application form |

3 Feb '26 - 16 Mar '26 | COMEDK Application Form 2026 |

5 Mar '26 - 13 Apr '26 | IISER Aptitude Test 2026 Regis... |

JAC 12th Exam

Student Forum

Answered a month ago

The board released the JAC class 12 time table 2026 online on its website. Students can visit jac.jharkhand.gov.in to downloaf the Jharkhand Board 12th exam date sheet 2026. We have also provided the updated JAC Inter exam date sheet 2026 on this page.

M

Contributor-Level 10

Popular Courses After 12th

Exams accepted

CA FoundationExams accepted

ICSI ExamExams accepted

BHU UET | GLAET | GD Goenka TestBachelor of Business Administration & Bachelor of Law

Exams accepted

CLAT | LSAT India | AIBEExams accepted

IPMAT | NMIMS - NPAT | SET

Exams accepted

BHU UET | KUK Entrance Exam | JMI Entrance ExamBachelor of Design in Animation (BDes)

Exams accepted

UCEED | NIFT Entrance Exam | NID Entrance ExamBA LLB (Bachelor of Arts + Bachelor of Laws)

Exams accepted

CLAT | AILET | LSAT IndiaBachelor of Journalism & Mass Communication (BJMC)

Exams accepted

LUACMAT | SRMHCAT | GD Goenka Test

Exam On - 3 Feb '26 - 23 Feb '26

Exam On - 3 Feb '26 - 23 Feb '26

Where can I access the JAC Class 12 exam date sheet 2026?